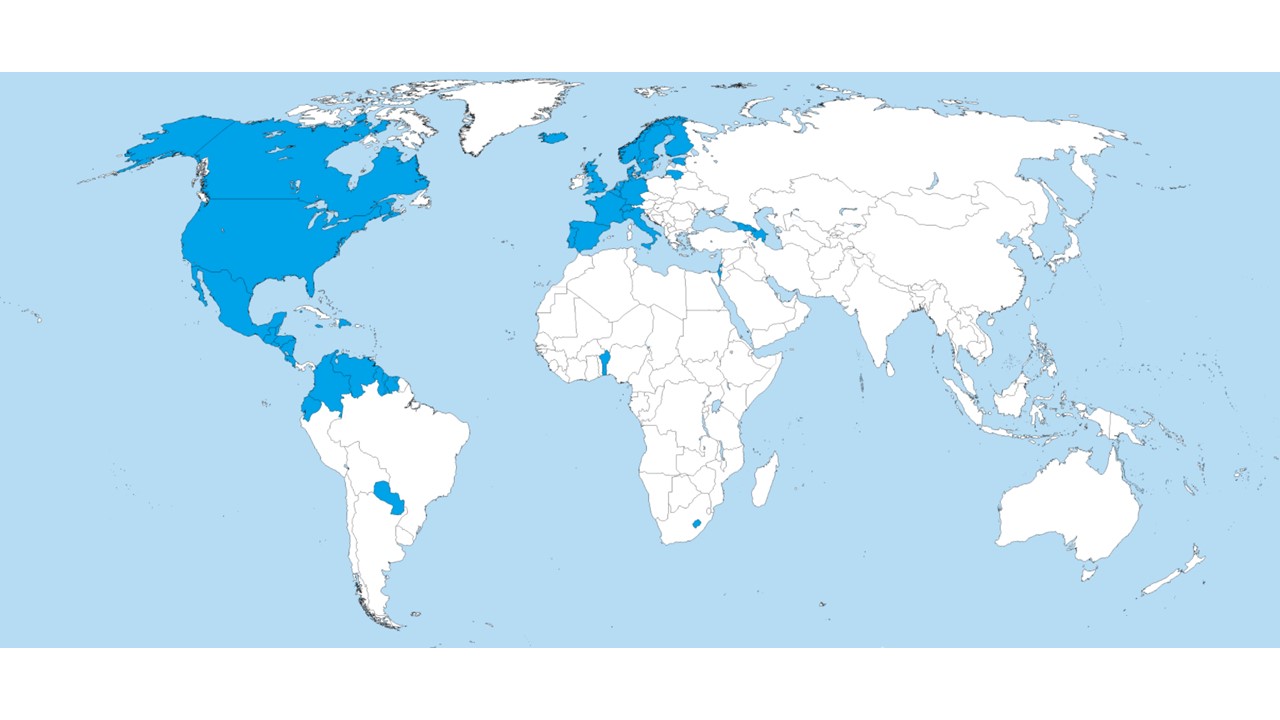

The map above shows countries where the U.S. trades more than China (blue) and countries where China trades more than the U.S. (white). China has effectively limited U.S. trade dominance to Europe and North America.

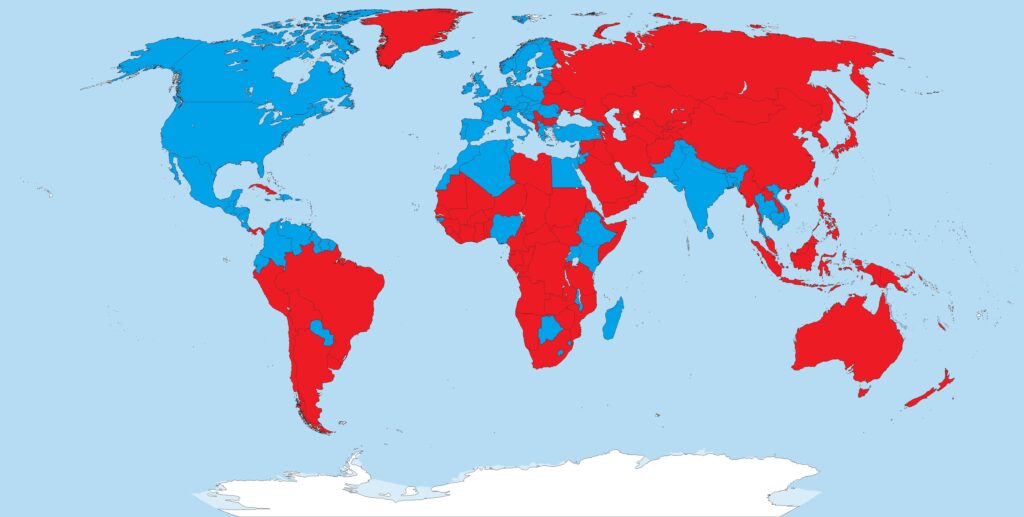

China and the USA are locked in a battle for global influence, and right now, it’s a dead heat. But the scorecard doesn’t look good. While the US still holds sway in 105 countries, these represent only 3.9 billion people. China, on the other hand, dominates in nations comprising 4.3 billion – a demographic advantage that speaks volumes.

How is influence bought and paid for? Trade, aid, and loans. And while the US boasts a larger trade budget overall ($3.8 trillion vs. China’s $2.6 trillion), China is strategically deploying its resources, forging partnerships with countries it deems vital to its interests. Case in point: Brazil. Last November, Brazil quietly aligned itself with China as a strategic partner, a move largely ignored by Western media. This is alarming, given that Brazil was previously designated a Major non-NATO ally by the Trump administration.

China’s strategy is clear: out-trade its rivals. Each year, its import budget grows, and it focuses on nations that can supply essential goods and resources. This targeted approach allows China to maximize its influence while minimizing expenditures on non-essential imports.

A glance at the global trade map is revealing. South America, the Middle East, and much of Southeast Asia are awash in red, signifying China’s dominance as the top importer. The US, represented in blue, is losing ground.

This map shows all the countries where China’s imports exceed those of the USA. While the USA imports from more countries overall, many are small. As we can see, China dominates trade with most of the larger countries in the Global South.

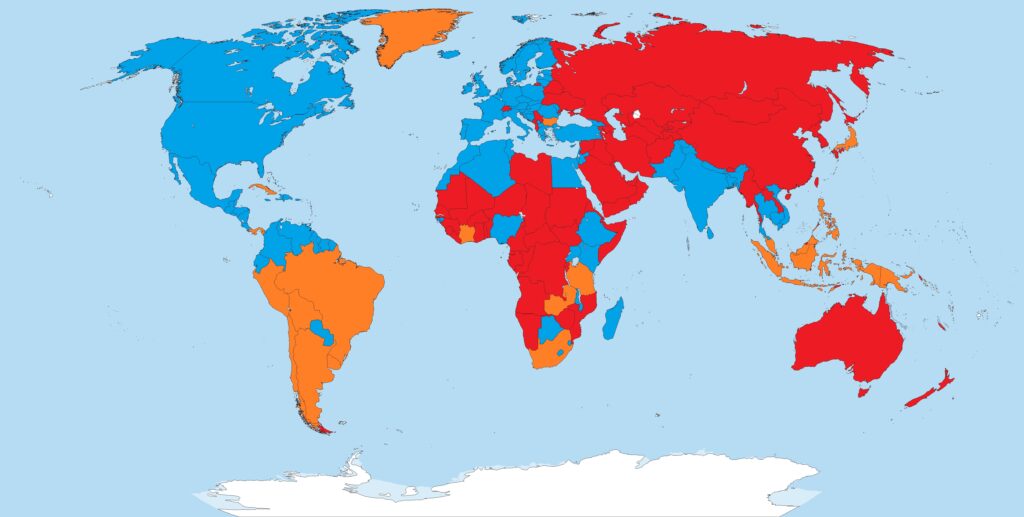

But this trend isn’t irreversible. My analysis shows that by strategically shifting approximately $300 billion in trade from China to 17 key countries, the US could regain its footing and influence a population of over 5 billion people. These countries include: Argentina, Bolivia, Brazil, Chile, Ghana, Greenland, Indonesia, Japan, Malaysia, Panama, Papua New Guinea, Peru, the Philippines, South Africa, Tanzania, Uruguay, and Zambia.

This is what the map would look like if the USA aimed to out-import-trade China and reclaim its influence in South America, as well as in Southeast Asia, currently under China’s sway. The path is clear: balanced trade with China. The orange are countries that would be flipped to the side of the USA.

This won’t be easy. Brazil, under its current leadership, prioritizes ideology over economic pragmatism, making it resistant to US-led free trade initiatives. Additionally, India and Bangladesh pose a competitive threat, offering lower prices on many goods.

To counter China’s growing influence, the US needs a bold, multi-pronged strategy:

- Targeted Tariffs – To balance Trade

- Component Tariffs – To shed chinese components from all imports to the USA – which forces all countries to buy less from China.

- Bilateral Free Trade Agreements: Actively pursue free trade agreements with the 17 target countries, reducing barriers to US goods and services.

- Strategic Sourcing: Shift US consumer product imports and electronics away from China and towards nations like Indonesia and Malaysia, which offer competitive advantages in consumer goods and electronics.

- Alliances: Convince Europe, India and other alliances to balance Trade with China to remove their trade surplus.

- Latin American Focus: Prioritize trade with Latin American nations like Argentina, Peru, and Bolivia, potentially through targeted tariffs on clothing imports from other regions, to boost their manufacturing sectors. Currently Latin America has a $27 billion dollar trade deficit with the USA, meaning they are fare traders.

- Further Re-alignment: Convince trading partners to buy more from these 17 countries.

Brazil: Brazil presents a difficult challenge. As an expert on Brazil, I can attest that the country is trapped in a cycle of detrimental policies. Though its people are eager to work, excessive regulations create insurmountable barriers to employment. This is reflected in the trade imbalance: China imports $82 billion more from Brazil than the United States does.

One of the most significant obstacles is Brazil’s radical left labor regulations. These regulations empower employees to sue former employers based on fabricated claims, potentially demanding all the wages they’ve ever earned. This creates a hostile environment for businesses and stifles investment. Furthermore, the labor code, coupled with a value-added tax system, is inefficient and riddled with corruption.

To overcome these hurdles, Brazil must establish free trade manufacturing zones, particularly in the more economically stable south. These zones would offer a streamlined regulatory environment, attracting investment and generating employment opportunities. However, even this solution faces potential pitfalls, as China will likely pressure its new strategic partner to distrust the USA and come up with legislation to prevent a re-industrialization.

One common sentiment I encountered in Brazil is that the United States merely exploits countries for cheap labor. This perspective on globalization struck me as odd, given the proven benefits of establishing factories. These jobs create prosperity, improve lives, and raise living standards. While people are indeed required to work, the relationship is mutually beneficial. China is a perfect example of it and China is also the entity that pushes this ideological statement into Latin America.

There is a knock-on effect. Latin America has historically reciprocated when the USA increases imports from the region. The USA has, for the most part, balanced trade with South America, and increasing imports by $100 billion would likely result in the USA exporting $100 billion more to these countries. So, although manufacturing in South America might be slightly more expensive, the potential to increase US exports by $100 billion justifies imposing further tariffs on China.

Wake-Up Call:

This is a wake-up call. The US can no longer afford to be complacent. Any strategy is better than free trade with China. It’s time to implement a strategic, American trade policy that reclaims our global influence and secures our economic future. The choice is ours: continue down the current path, or fight back with a new set of rules.