If you are an investor, have you ever noticed that things seem expensive? If you want to buy a company’s stock, you see that the valuation is elevated, so you look for a different company to invest in, and those valuations are also elevated.

If you are a wealthy individual and you have a nice house in the city you live, and you want to buy a beach house or a house at a ski resort in Colorado, have you noticed that the prices are more expensive for your second home than your primary home, where you spend the most time?

If you are a wealthy art collector, have you noticed that paintings that were selling for $1 million to $5 million 40 years ago are now selling for $150 million to $300 million today? Yet, during this time, purchasing power based on inflation only increased by 2.93 percent.

If you were a billionaire in 1985, or maybe the son of a billionaire, and in 1985 you had a private jet, and today you have a private jet, the jet costs so much more money than it did when you were flying with your wealthy parents.

Have you ever noticed how the wealthy have so much money they don’t seem to know where to place it? For example, Jeff Koons made a stainless steel rabbit, slightly over 3 feet tall, in 1986, and it sold in 2019 for $91.1 million. My daughter bought a similar rabbit on vacation at a souvenir shop in Los Angeles for $18 and uses it as a piggy bank.

This was in 2019. There was no stock market bubble in 2019; it was just business as usual.

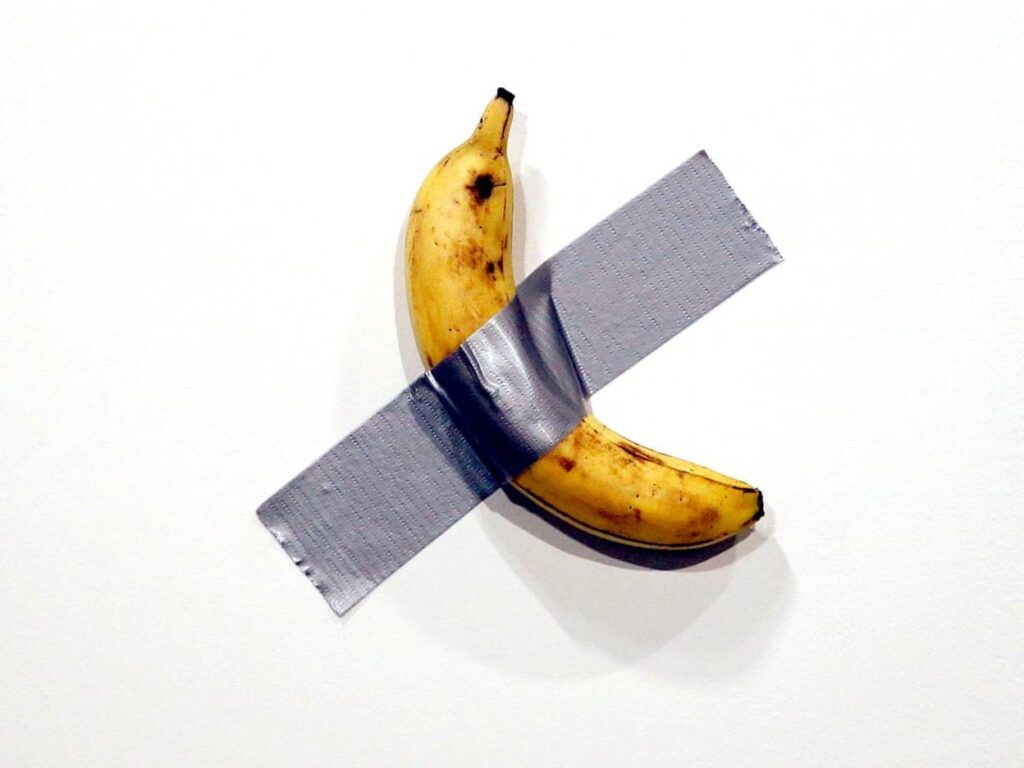

Have you noticed when people of wealth have so much money they don’t invest, but just throw it away? Such as paying $5.2 million dollars for a duct-taped banana.

Or a JPEG file, called by a fancy name, an NFT, sold for $69 million.

Housing is something else. For an upper-middle-class individual, a new house will cost no more than 50% of what it cost to build. However, in the case of houses that are desirable by the rich—those in the mountains, by the sea, or along a lake—they are in limited supply and may cost as much as 20 times what they cost to build. The wealthy each want one, and they typically want them in the same locations, so the wealthiest can drive up the price until they outbid the less wealthy. The value of the house doesn’t matter to a person with more than $50 million, as they can afford it. They have all the money in the world.

There is factually a wealth bubble, and this wealth bubble was created because there is too much money in the hands of too few people. The wealth bubble is the culmination of 45 years of loose tax policy on the top 2%. They have become so wealthy that they have started to bid up the items they have a common belief they must have.

Most will say, “Bah, humbug, you are wrong, there is no wealth bubble.” However, there factually is, and it is because the concentrations have become out of whack. The prices of objects that the wealthy buy have been so inflated, compared to the rest of the market, and the value of stock valuations has become incredibly elevated, not just in the last few years, but in the last 12 years.

Let’s give some logic:

- 50% of all consumer spending is now being completed by the wealthiest top 10% of consumers. The long term average is that the bottom 90% account for 73% of all consumption.

- The top 1% control 30.8% of the country’s total wealth. In 1980, the top 1% owned 7% of the country’s wealth.

- The statistics state the middle class in 1980 was 51%, and in 2025 it is also 51% of the population. However, I believe this is incorrect, as that would mean that 39% of the population is in the lower class. If a mortgage is $2,000 per month, taxes, utilities, and maintenance on the house are $1,000 per month, and having kids is a huge expense, that means to own a house and be in the middle class, a person would need to be making at least $80,000 per year. The point is, the statistics claim a salary of $48,000 to $75,000 would count in the middle class. That is only the case if the two people are single with no kids, which is why many are not having kids, as responsible people know they can’t afford it. The point is, since 1980, the middle class has been cut in half, from 51% to 26% today. The working poor are everyone in the bottom 65%.

This wealth bubble has been checked a few times: the tech crash in 1999 and the Great Financial Crisis. During these events, disproportionate pooling of wealth meant mom-and-pop investors and retirement accounts took the brunt of the falls, while the wealthiest were given bailouts.

Why do the rich have the ability to accumulate money? Well, for people who inherit money, they invest it and never spend all the money they make in a given year. It compounds and grows. The self-made millionaires, who are more frugal from the start, once they make $1 million, are probably making 10% to 12% per year on that money. The money they make in one year from the principal wealth is more than a person in the middle class, or in many cases, multiple people in the middle class, make in a year. The gift of wealth starts to lose control when the money becomes so obscene and so high that it doesn’t matter anymore. The reality is 45 years of lax tax policy on the wealthy has now accumulated to a point of ridiculous values they have absolutely no place to put it.

Values accumulate, and people start buying things they want because that is what some wealthy friend wants.

Here is the problem. I will give an example. There is inflation. In 1980, a beach house in Saugatuck, Michigan, owned by my wealthy aunt from Napa, California, was worth $100,000. By 1998, it was $480,000, and by 2025, it is worth $3 million. But what happened in 2025 to make this old, non-insulated house, built in 1890, worth $3 million?

A house in nearby Grand Rapids in 1980 would sell for about $60,000, so yes, the beach house by comparison was more expensive and took a 50% premium on the normal middle-class residence. However, by 2025, the normal middle-class residence was worth $360,000. So yes, it went up by six times. It would actually cost more to rebuild it than it sells for. The premium for the beach house is 833% more. This is because of the wealth bubble, along with all the other examples.

Except in rare occasions, the world is not creating additional beach property, the world is not creating additional ski resorts, and, in fact, ski resorts are closing more often than opening. Yet, the price for the real estate has detached from reality, and the reality of art has detached. The value of stocks in the stock market has detached from reality as well.

There is something like $7 trillion sitting in money market accounts that can’t find a stock or bond investment that makes sense.

So, what ignited this wealth bubble? It’s quite straightforward: the change in the tax system that began in 1980. In 1978, the effective tax rate on the wealthy exceeded 70%. However, loopholes, deductions, and write-offs were rampant; even country club memberships could be claimed as business expenses.

The tax system essentially operated on the principle: “If you can spend it, you can find a way to deduct it. Then, whatever remains is taxed at 70%.”

The wealthy resented this, as it meant they were spending money and enjoying a comfortable lifestyle, but still paying a high percentage in taxes. Then, in the early 1980s, under President Reagan, the tax system shifted. Taxes for the wealthy were halved and eventually settled around 39%. There were some fluctuations as the government began accumulating substantial debt.

The wealthy had access to the same luxuries in the 1980s and 1990s as they do today. However, by 2025, a significant imbalance emerged. The wealthy began accumulating so much money that they could neither spend it all nor find suitable investment opportunities for it. Money naturally flows towards the wealthiest individuals in society.

As stock market valuations reached increasingly inflated levels, everyday individuals’ pension funds and 401(k) contributions poured billions into retirement accounts, purchasing already inflated stocks. This situation further benefited the wealthiest, who are the majority owners of those companies.

Solutions and Potential Triggers for the Wealth Bubble Burst:

Proposed Solutions:

- Progressive Inheritance Tax:

- Implement a progressive inheritance tax designed to generate $1 trillion annually over 20 years.

- These funds would be specifically allocated to reduce national debt.

- Capital Gains as Income:

- Tax capital gains as regular income for individuals within the top 2% of earners.

- Tax Relief for Lower-Income Individuals:

- Eliminate all income, payroll, and property taxes for the bottom 50% of earners.

- Rationale: Individuals with limited income should not bear tax burdens, as their earnings are primarily spent on essential needs (rent, food, childcare), thereby stimulating the economy.

- Reduce property and income tax rates for the bottom 65% of earners.

- Eliminate all taxes and Social Security contributions for the bottom 30% of earners.

- Restructured Tax Bracket for the Top 1%:

- Establish a tax bracket for the top 1% that more closely resembles the 1970s tax code.

- This framework would encourage capital expenditures and business write-offs, as well as personal deductions for spending. Yes, more loopholes, the goal is to have these millionaires and billionaires to build new buildings, new factories, new hotels, and not buy new houses, not invest in equities which certainly will inflate. The scret to tax code is that a high income and capital gains tax (at least 60%), with numerous ways to write-off and deduct spending. (e.g., if you spend it, you will not be taxed on what you spend)

- Objective: Incentivize the wealthiest individuals and companies to invest in tangible assets (e.g., new factories, businesses) rather than solely in equities and bonds.

- Restructure the tax for people making less than $50,000 per year, lets face the reality: People making less than $50,000 per year spend 100% of their money. This is a good thing as they spend they consume, as there are 170 million of these people, it adds up. Forget no taxes on tips, it is simply better that a person making less than $50,000 should not pay taxes on anything. Let them spend!

Potential Triggers for the Wealth Bubble Burst:

The issue is the solution will also trigger the bursting of the bubble.

- Significant Tax Policy Changes: The implementation of any of the proposed solutions could cause a dramatic shift in market behavior.

- Economic Downturns: Future economic downturns are less likely if there are less large pools of money shifting around with no home.

The current reality of individuals working three jobs just to afford basic necessities like food and rent is nothing short of a perpetual economic depression. It’s a modern-day crisis, and the most effective relief would be substantial tax reductions for the bottom 65% of earners, enabling them to regain financial stability and boost consumption.

My central argument is that a wealth bubble burst wouldn’t drastically alter the lives of the wealthy. They’d simply need to exercise greater caution in their spending and investment decisions. Perhaps they’d refrain from purchasing grossly inflated properties or houses used only for a few weeks annually (e.g., ski lodge). They’d experience a slight adjustment, becoming a bit more like the rest of us.

Instead of flying private for every trip, they might choose first class. Instead of four homes, they might opt for three. They’ll still have ample funds for lavish Christmas gifts, everyday fine dining, and luxury vehicles. Their day-to-day spending habits would likely remain largely unchanged.

The worst outcome of a wealth bubble burst would be the deflation of high-end residential real estate, like a deflating balloon. (e.g., These are the $50 million dollar houses which will now sell for $30 million.)

The most significant positive outcome of a wealth bubble correction would be the United States government’s immediate resolution of the national debt crisis.