What is going on? Why do I think a second Great Depression is coming?

Consumers drive the economy, but each year the number of consumers with disposable income shrinks by at least one million, a trend taking place for 40 years, as too many find they have less and less disposable income to contribute. The U.S. economy is based on millions of people with disposable income buying the things they want. This is ending and will hit a tipping point in the 2030s, where too many people will have entered a poverty class or the working poor.

Unemployment will rise, and as unemployment goes up, more and more people will draw from 401(k)s and other savings in the stock market. If unemployment, due to artificial intelligence or a general recession, hits 6%, then net withdrawals from the stock market will take place—meaning more money is leaving than entering. Six percent is the turning point: if 6% are unemployed, then net withdrawals from the stock market happen, which causes the stock market to drop. A falling stock market is bad for the Main Street economy because the top 10% pull back on discretionary purchases, further straining the economy.

Retirees will be equivalent to 17 million people exiting the workforce and now living off retirement savings. It will be a bloodbath, and a smart retiree by 2028 will withdraw most of their stocks and place them into safer, no-risk investments. The reality is that adding 17 million retirees will bring the retiree ranks from 55 million currently to 72 million. This will create a huge net withdrawal from the stock market as retirees draw down their savings to live. As the cost of living increases, many people will have to draw down more than they planned.

Demographic decline in the U.S.: as these 17 million quickly leave the workforce, less qualified and, in some cases, underprepared younger people will be filling the ranks. This huge drop in highly qualified baby boomers is going to put a strain on the economy. Or, if the 17 million people leave and AI replaces them instead of humans, too few people will be working in the economy. This results in too few people contributing to 401K and retirement accounts.

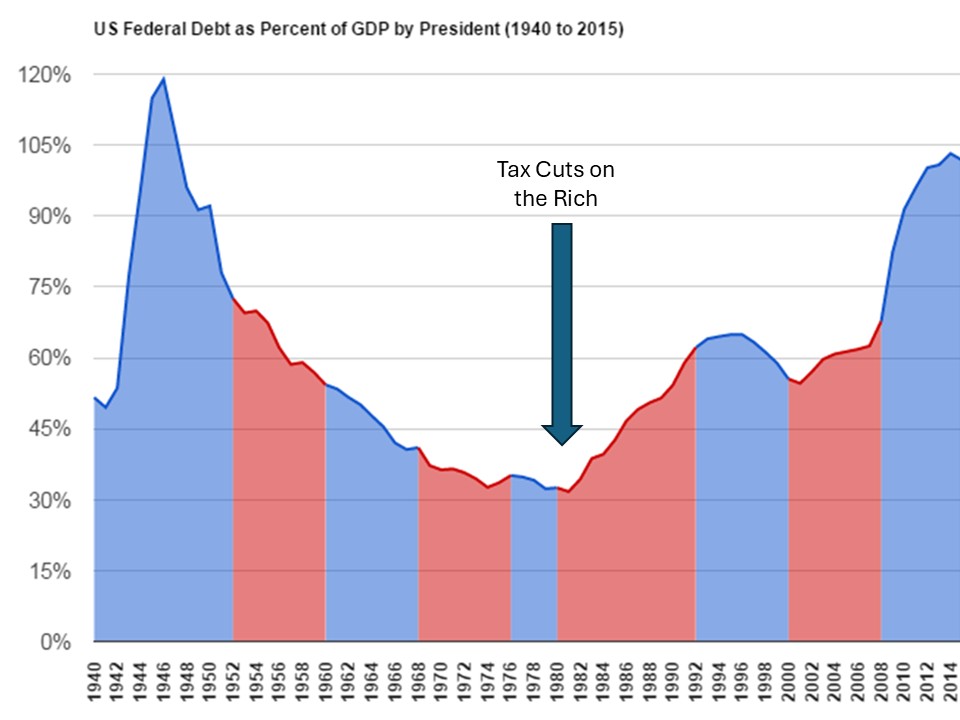

We are running a government deficit at 6% and this normally runs at 3%. No matter what the government, the Federal Reserve, or the Treasury do, this will result in 3% inflation, meaning that over 10 years, the purchasing power for the bottom 99% will fall by at least 30%, further straining the situation. The main reason that the bottom 90% are losing purchasing power is because of a growing government debt to GDP ratio.

Lastly, money printing: Since COVID, the U.S. had to print so much money that inflation was much worse than the official numbers. The bottom 80% has had their standard of living utterly destroyed, while billionaires and multi-millionaires have become incredibly richer. As the bottom 90% lose purchasing power, consumer spending is increasing, driven by the top 10%. The bottom 90% have already pulled back on consumer purchases because they are living paycheck to paycheck, and many are maxed out on credit card and student loan debt.

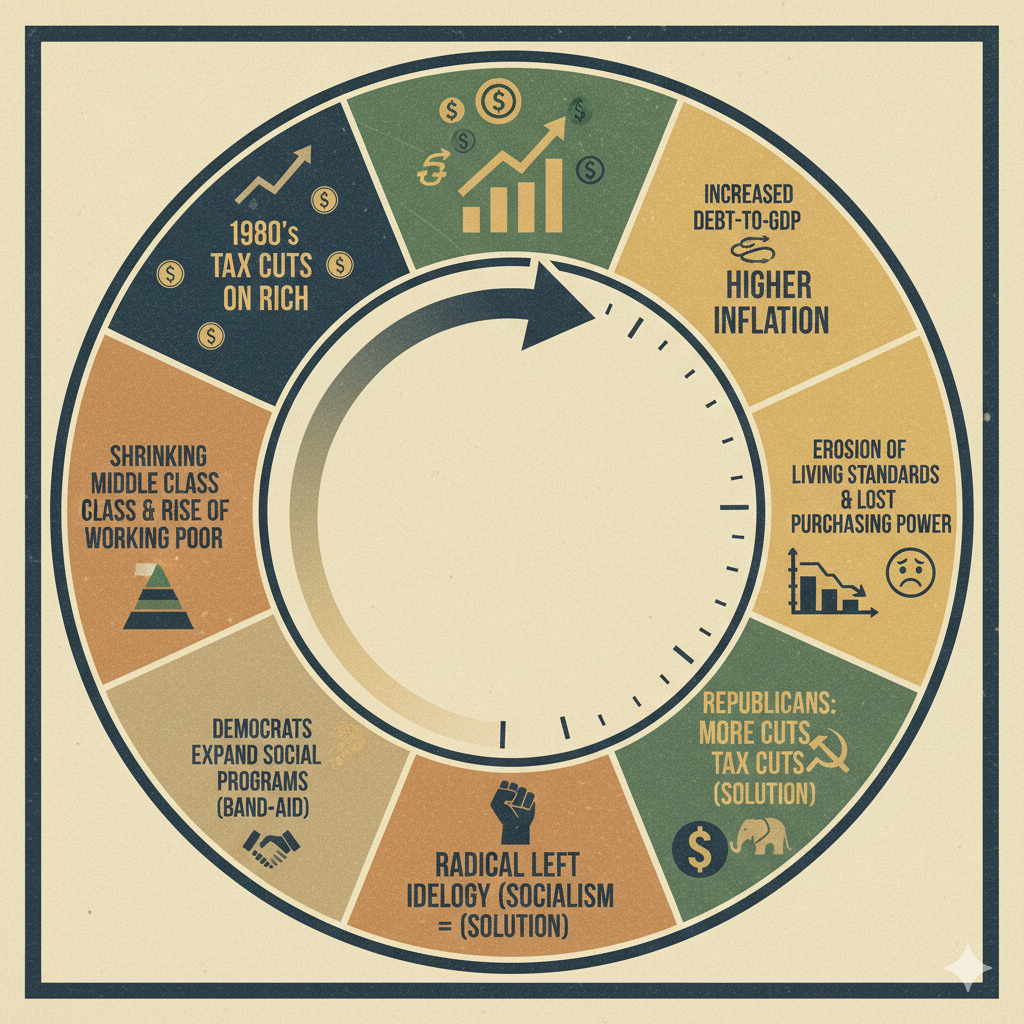

From 1950 to 1980, the middle class grew nearly every year. In many cases, people were able to get by with one adult in a household working. From the 1940s to 1979, at no point was the tax rate on the top 0.1% less than 61% (typically around 70%). Since 1980 to the present, the middle class and poor have seen their standard of living eroded away each consecutive year. If it were not for cheap imports helping cushion the lost purchasing power, things would have been far more dire. What caused this? If you talk to the right, they blame immigrants; if you talk to the left, they blame outsourcing and the wealth gap. If you talk to the right they say: Lets lower taxes even more on the the rich and if you talk to the radical left, they want to implement social change by providing more welfare and socialist policies. However, the fact is, it was the cause and effect of a few things:

For years, I pondered and would stare out at the horizon, trying to figure out how the politicians duped the middle class into believing that everything else was responsible for their decline since 1980—except the tax cuts that took place that year—until it came to me like a light bulb on September 20, 2025, and so I wrote this.

First, the debt-to-GDP ratio was decreasing from 1946 to 1980. This means that each year, fiscal constraint was more pronounced, government was more responsible, the economy grew, crises still occurred, but because the overall debt was not rapidly expanding, the inflation that did occur did not eat into purchasing power as severely as when debt-to-GDP is expanding.

Second—Tax rates from 1940 to 1980 were always about 70%, and the wealthy basically had a million loopholes. Here was the secret: The argument by the rich to lower taxes was, “We don’t pay 70% anyway, as it is full of loopholes, so let’s remove the loopholes and you drop our rate”

This was a major error. Today, we hear that the wealthy are job creators and need lower taxes, or they will flee the country and go to another country with lower taxes.

The reality is the reason high taxes with numerous loopholes worked is because the loopholes and write-offs absolutely forced the wealthy to spend money, pay down business debt, and improve their businesses if they owned a private company. Higher taxes on business owners factually will create more jobs, this is a fact

These high taxes and the forced spending helped prevent the wealthy from becoming astronomically wealthy. However, it helped their businesses grow, while they spent money on as much as possible, such as creating jobs.

Third—What happened when taxes were dropped from 70% to about 35%, and capital gains dropped from 35% to 20%? Most loopholes were filled, but many were not, so the effective rate still went to 24% for the ultra-wealthy. For many years, the official tax rate on the wealthy was 39.4%, but their effective rate was 24%. They were still able to use many loopholes. They were able to keep 76% of their money, and this money simply compounded for 45 years exponentially, while for the last 45 years, the middle class and poor saw their income eroded each year by inflation.

As the Government collected less taxes, and as the bottom 90% lost purchasing power a few things happened: The democrats pushed for programs that will help cushion the bottom 90% bad situation, and the rich and in most case the Republicans did not realize that their tax cuts on the wealthy, were driving a social safety net program. Worse of all is that as the government printed more money, increased the debt to GDP ratio over the last 45 years, purchasing power became worse for the bottom 90%, create a spiral of more safety net programs, more welfare, and further increased debt to GDP ratio. This was a death spiral creating a loop of expansionary government spending and further exacerbating the debt to GDP ratio.

The conclusion is this: High deficits and high debt-to-GDP cause inflation. Inflation is a tax on the bottom 98%; it erodes purchasing power, erodes the standard of living, and this erosion over 45 years has shrunk the middle class. Each period leading up to a crisis was a reprieve as things improved; however, right after the crisis, the government was required to hit the printing press, pumping out trillions, diluting the money supply, expanding the debt-to-GDP ratio, and causing standard of living to fall even faster. Each crisis resulted in more social safety net programs.

On the side of the top 2%—but really the top 0.1%—they are both the beneficiaries of increased government spending, as many of their companies have contracts with the government. They are the beneficiaries of globalization, as they can outsource to cheaper manufacturing countries. But the main reason they have been growing their wealth each year for the last 45 years, and why after each crisis they come out richer, is down to one simple thing: Their effective tax rate is too low, and because they sit on wealth, if things are at a standstill for the bottom 98%, the top 2%—but really the top 0.1%—see their wealth grow as asset bubbles inflate due to inflation.

The False Hope Solutions:

The solutions presented to resolve the debt situation are worse for the bottom 98% and will further erode their purchasing power. One proposal is devaluing the dollar to devalue the debt. A 20% devaluation would reduce purchasing power by at least 15%, as everything imported into the U.S. becomes more expensive.

Blaming immigrants and stopping immigration to drive wages up is not a solution, as those wage increases of 20% won’t fix the massive deficit spending, which is over 6% right now.

The reality is if you have a family come to the USA, they need a house, this is right there going to drive the economy, that family will also become a consumer.

Immigrants do not hurt the economy, and not having immigrants is not going to drive up wages. The fact is everyone making less than 500,000 dollars per year are really all in the same group: A group that has erosion of purchasing power because the government prints too much money.

The Solution is Simple:

The U.S. needs to implement a core policy: Deficits cannot be more than 2%, and the debt-to-GDP ratio must not exceed 80% and should always be in decline. The inflation target should be less than 1.5%, down from the current 2% target.

If the USA grows at 2.5% per year, the deficits should be at least 20% less than this at about 2%. This will create a declining debt to GDP ratio, and the erosion of purchasing power won’t take place.

There are three things that need to be fixed:

- The debt and deficit issue – via tax raises on exclusively the top 0.1% about 160,000 families and individuals.

- Assisting the bottom 80% in getting out of a horrible economic depression, where they are the working poor, barely making ends meet, despite having what would appear to be amazing salaries 20 years ago.

- Assisting the 80% to 99.9% from having an erosion of purchasing power.

To do this, there is a solution that hurts 160,000 households but helps 130 million households.

This is all really about wealth-building for the bottom 80%, savings-building, and the reality is only the top 20% can build any type of assets today. The 80th to 99th percentiles can build assets, but not wealth. Even someone with $5 million in the bank is really the new middle class; that is assets, not wealth. To be truly wealthy today, you must be in the top 0.1%.

So the goal for the bottom 80% is to help them keep more of their money so they can live a better life . The fact is politicians should from an economic perspective focus on ending this never ending depression for the bottom 80%, and basically state: people making less than $50,000 don’t pay taxes.

What does cutting taxes on the bottom 72% of the population do?

- It increases consumption, as the bottom 72% won’t save this money; they will spend it. Companies receive this money and grow, and rich people make more profit: more restaurants, more car sales, more phone sales—everything.

- It also takes severe pressure off this population so they have more money. Many will be able to start to save.

The debt situation is bad and inflation will only get worse.

I have heard more lies out of politicians and pundits about the U.S.’s fiscal health than any other topic. Here is the fact: The U.S. can run a 3% deficit because it grows about 3% a year. It actually has no choice but to run a 3% deficit or there will be deflation.

Now we are growing at 2% and running a 6% deficit, meaning we are printing more money each year than we are growing by 4%, and thus we can expect about 4% inflation each year. This is going to be a major drag on U.S. consumers. Their money is inflating, while the billionaire class will see the numerical value of their wealth explode, potentially creating the first trillionaires and further widening the wealth gap.

This means consumer buying power for everyone in the bottom 90% will erode, further weakening the U.S. economy.

Neither the Democrats nor the Republicans want to address the fact that consumers are having their purchasing power eroded, that the top 10% are really driving economic gains, and that when the top 10% pull back, there will be no one to drive the economy forward. This is a serious economic disaster that is going to hit the middle class further and risk a depression situation. The middle population between 30% and 90% always drove the economy, however now they can only afford rent, food and a car.

There is only one solution to the debt: a bailout by the rich.

Past Solutions won’t work: Why the rich? while in the past the government simply printed money, diluted the money supply, and eroded the purchasing power and standard of living of the bottom 99%, unfortunately due to the fact the government is now printing money to pay down the debt, means that this plan won’t work.

The debt needs to get under control, the deficit needs to come down to 2%, and the debt-to-GDP needs to come down to no more than 80% of GDP (currently at 118.4%). To pay this down would require about $8 trillion.

There is expected, over the next 20 years, a $60 trillion to 100 trillion wealth transfer from the top 2% down to their heirs. Currently, the amount of money that can be transferred to heirs is about $15 million per adult, so $30 million from parents to children. This is, for all intents and purposes, a huge lost opportunity to help very rich people preserve their wealth in dynasties.

The U.S. should first implement a progressive inheritance tax:

- Under $1 million or up to 1,000 acres of farmland: no tax.

- Over $1 million and over 1,000 acres of farmland: 10% tax

- Over $3 million: 15% tax

- Over $5 million: 20% tax

- Over $7 million: 30% tax

- Over $15 million: 40% tax

- Over $30 million: 50% tax

- Over $50 million: 60% tax

- Over $1 billion: 70% tax

- Over $10 billion: 80% tax

- Over $100 billion: 90% tax (My God, I must be nuts to state a 90% tax, however heirs shouldn’t have this much money anyway. It is still over $10 billion, which still means super yacht, private jet, and mansions all over.

For incomes or capital gains, right now, about 37% and 23.8% tax is paid, not including state taxes. This should be the same at no less than 60% flat for all income, and 60% for capital gains over $3 million. Even a new brack from 1,100,000 to 3,000,000 should be raised to 48% flat for both capital gains and income. The top 0.1%, or fewer than 160,000 people in the U.S. This will greatly help raise money and should be enough to bring the deficit down to 3%. It affectively doubles the taxes on the ultra wealthy.

Repair Consumer Spending:

Consumers need more money to get by, and to be honest, they just don’t have it. Politicians should stop rewarding the rich with free money via tax cuts and start rewarding the rich with more clients for their businesses.

The best way to save the economy, supercharge growth, and supercharge consumption is to do the following:

- A family making $50,000 a year pays about $2,000 in federal taxes;

- A family making $80,000 a year pays about $5,343 in federal taxes; with two children, it is $943.

- A family making $100,000 a year pays about $7,743 in federal taxes; with two children, it is $3,343.

- A family making $150,000 a year pays about $15,898 in federal taxes; with two children, it is $11,498.

The reality is three categories of tax cuts and rebates:

- Any individual making less than $50,000 per year should pay no federal taxes (it is simply not worth the time and paperwork for a person making this muchy money to pay taxes at all)

- Any couple making less than $100,000 per year should pay no federal taxes.

- Any family making less than $125,000 per year with one child should pay no federal taxes; with two children, $150,000; with three children, $175,000.

The tax saving are huge, and in many cases these people will invest this money back into he stock market, to help offset the retirees’s withdrawals.

For those in the working poor:

- Individuals making less than $40,000 per year should get a federal rebate for all state sales tax and property tax up to $2,000.

- Couples making $60,000 per year should get a federal rebate for all state sales tax and local property tax up to $4,000.

- Families making $60,000, plus $20,000 more for each child, should get a federal rebate for all state sales tax and property tax up to $6,000.

A rebate is a check from the federal government, the reason it is not a tax credit, is none of this population would pay federal taxes, so the tax credit would do nothing.

For those living in poverty, include food assistance and utility rebates as well as the benefits listed above.

- Individuals making less than $20,000 per year should get all the above benefits, plus utility rebates, and receive essential, healthy, non-perishable, low-processed staple food baskets each month, such as rice, beans, lentils, pasta, canned fish, canned meat, and canned vegetables—equivalent to one meal per day per person in the household. This person would qualify for Medicaid.

- Couples making less than $40,000 per year should get all the above benefits, plus utility rebates, and receive essential, healthy, non-perishable, low-processed staple food baskets each month, equivalent to one meal per day per person in the household. These couples would qualify for Medicaid.

- Couples making less than $40,000 per year, plus $20,000 for each child, should get all the above benefits, plus utility rebates, and receive essential, healthy, non-perishable, low-processed staple food baskets each month, equivalent to one meal per day per person in the household. This family would qualify for Medicaid, which currently requires a family of three to earn about $26,000; this would raise the amount to $60,000.

(Clearly I don’t have the computer system to know that raising taxes on the rich and inheritance, will be enough to both reduce the annual defecit to 1.5% and to also be able to afford cutting taxes for families of 4 making $150,000, so what I can say is that if we don’t go as high as $150,000, we state $40,000 for individuals no tax, $80,000 for couples and for each child counts at $21,000 dollars (as the median cost to properly raise a child is $21,000 to $23,000 per year) for the first child and $19,000 for the second, and $15,000 for the 3rd.. This would put it at $101,000 no taxes with one child or $120,000 no taxes the 2nd. The point is no taxes has to be part for the working poor and middle class, in order to increase consumer spending by at least several hundred billion per year.)

I have found a way to pay for the expanded Medicaid program, basically taking a family of 3 that would be making less than 26,000 a year, to allow a family making less than $60,000 a year to use Medicaid.

Why these staple foods instead of allowing the Food Assistance recipient to buy for themselves? The fact is that we are expanding the food assistance program by millions of people, and we want to cut out waste where over 10% is spent on sugary carbonated beverages. Assisting people in creating health issues is not the goal; we also want to help farmers in the Midwest who grow beans.

Companies with fewer than 100 employees should not be required to buy health insurance for those employees; however, companies with over 100 employees should be required to pay for health insurance for those employees.

I am not an advocate for welfare; however, I am an advocate for allowing people to keep what they earn, especially when they can barely get by as it is, so they have the ability to be good consumers. Welfare should be for people who cannot work, and the working poor should pay zero tax and should have assistance on utilities, state sales tax and in many cases healthcare if they make less than a certain amount.

I can say that with all this, it is not a huge savings, however, by having sensible taxation policy for the top 0.1%, the 0.1% will be richer in real terms as their businesses take off.

I haven’t calculated the exact amount, but this would be over a $5 trillion wealth shift over 10 years from the top 0.1% to the bottom 70%. As these millions of households get relief—100 million households gain this $500 billion per year—they will spend it on companies, and these companies will grow their earnings and revenue. Apple becomes richer, Amazon sells more products, the ultra-wealthy have less money, but it goes further when they buy things.

Income and capital gains tax:

The top 0.1%:

The next thing that needs to be done is to help the effective tax rate rise from about 24% for the ultra-wealthy—the 0.1%, those making over $3 million per year—and this would involve the following:

- A 60% income tax rate and a 2nd 90% spending requirement tax.

- A 60% capital gains tax rate and a 2nd 70% spending requirement tax. Withe the right to deduct state capital gains up to 12%. Thus in the case of California wit h a 12.3% rate, the total rate would be 60.3%. Thus making it so that the capital gains rate for the top 0.1% is about the same nationwide, which prevents multi-millionaires from changing tax domicile, as there is no benefit to move to Florida to save money.

The goal is to have the effective tax on the top 0.1% rise from 24% to 60%, which more than doubles their taxes. This will almost immediately bring the yearly deficit in order along with a progressive inheritance tax. It should be enough to also pay for taxes for the working poor and a the lower tier of the middle class.

The spending requirement for both categories falls into several options for the top 0.1%:

This would be in effect until the debt to GDP falls below 80% of GDP. Upon that time the spending requirement is eliminated however the tax brackets at 60% stays.

- Pay down personal loans accumulated prior to the law taking effect

- Buy 30-year Treasuries

- Build housing—but not buy real estate, even personal housing, with a focus on millions of new affordable homes

- Build factory shells for manufacturing products, but not for product distribution

- If the money is not spent between 50% and 90% for income and 45% and 70% for capital gains, then the money is taxed by the government.

What does this law do?

- It causes the 30-year mortgage rate to fall, helping people buy homes.

- It helps the government finance the long-term national debt at much lower rates, as the purchase of 30-year Treasuries drives down rates.

- As the rich pay down their own debts, it causes general lending rates to fall, which helps people buy cars and take out loans. As the ultra-wealthy prioritize paying down their personal loans first, this will also cause lending rates to fall.

- It causes everyone in the top 0.1% to become home builders, who will build subdivisions, set up investment companies for building homes everywhere, which will take pressure off the population that can’t afford a home. As mortgage rates are lower, many will build homes for themselves, but eventually the market will be saturated with high-end homes and they will be forced to adjust.

- It helps the government get its factory footing, as people will build out shell factory structures just to place their money somewhere, then lease them to people who need a factory. As everyone does this, the lease rates will be low.

- It spends money in the real economy, not the Wall Street economy.

- It lowers the chance for speculative stock bubbles.

- It greatly raises the effective rate for the top 0.1% from about 15% up to about 28%; this means the government will take in much more money, nearly double the current rate for the top 0.1%. This will bring down the deficit.

- Most of all, this will slow, but not stop, wealth accumulation. The top 0.1% will only be able to use 10% of income and 30% of capital gains proceeds to reinvest into stocks, bonds, and real estate. This should greatly slow the growth of the wealth gap.

The wealthy will first use their money in their businesses, looking for deductions, loopholes and what not to spend the money so it doesn’t face a high tax when it transfers to the owner, they will opt to invest in the business rather than paying large dividends, or selling their business. This will create jobs, as their businesses grow. Then as the businesses run out of things to invest in, or to expand. The wealthy will then build houses, factories, and when that is saturated they will buy treasuries. However many will buy treasuries early as they know the treasuring yield will go lower as more buy.

- Let me be clear: We are going into a great depression in the 2030’s and we can still head this off by implementing these tax changes. The US government can not enter this with this massive debt or it will make things worse.

How long can the top 0.1% will pay 60% of their income and capital gains as taxe?

Forever, we saw what happened when the top 1% and top 0.1% have too much money. Asset bubbles are created, people seek out return on capital and stupid investments are made. The middle class gets hurt, the poor become destitute, and the government then needs to help these people with expanded social programs.

Demographics

Still, this change in taxation will greatly reduce the chance for a depression. It will not fix the fact that we will have 17 million people retire over the next five years, and this will severely hurt the stock market. The only way to correct that is at least 20 million young people entering the U.S., preferably ages 20 to 32. Don’t think that Biden’s policy to let in millions of immigrants was an error on his part, this was purposeful. The reason was that Congress has been deadlocked for 30 years on sensible immigration policy, and Biden realized that we were going to fall off this retirement cliff and wanted to bring in as many people as possible to offset it. The second reason was to hopefully have those who came in vote Democratic.

The solution is twofold and it serves the US national security geopolitical interest: Allow in all ethnic Russian females ages 18 to 30 from large metropolitan areas in western Russia and target 5 to 8 million. Allow only educated Russian men who have never served in the military to enter the U.S. in the same age bracket. Allow families into the USA from Russia with at least 1 child where the adults are not older than 35 years old. The goal is about 10 million people from Russia. The U.S. should then allow in educated Brazilians as well, ages 20 to 32 years all ages and backgrounds, to create a brain drain. Lastly, the U.S. should allow doctors from Brazil, South Africa, Cuba and Russia to enter less 50 years of age. There are two goals: to “population harvest” countries that have aligned against the U.S. with China. If they want to align themselves with China, to undermine the dollar, and to create a coalition of economies to stand up to the U.S., then the U.S. should undermine their economies via human extraction .

What does this do? Russia has an oscillating population, a remnant of World War II, so every generation there is a huge drop in population. By removing a vast number of females in what is currently the lower end of this oscillation (ages 18 to 30), it takes a very bad demographic situation and makes it untenable. Russia’s economy will collapse and eventually the country will break up into numerous republics, as Moscow will not be able to maintain control of regions already wanting independence such as Dagestan.

Brazil, which has vocally called for the world to stop using the dollar, is aligned with China. The propaganda that comes from China to Brazil via Cuba has brainwashed the population. This has resulted in a clear fact: Brazil is not an ally, and unless a miracle happens, they are part of an axis block against the U.S. Thus, the U.S. should take their best and brightest and as many doctors as possible.

The same for South Africa: The U.S. should take all their doctors who want to immigrate to the U.S.

Why women from Russia? There are about 10 million women who fall into the category of ages 18 to 30. The goal is simple: Take childbearing women to hasten an already horrible demographic decline.

How does this help the U.S.? Having 15 to 20 million more citizens over the next five years will greatly cushion the impending Great Depression in the 2030s. Having 20 million people working will offset the drawdowns in 401K by the 17 million additional retirees, it won’t be perfect but it will be much better.

These solutions:

All these solutions—from reducing the deficit to 1.5%, the progressive inheritance tax, as well as raising income and capital gains taxes, to the spending requirement or face a tax—will help the housing market and help force factory construction, and will slow the wealth divide.

Bringing in 20 million people who can work and add to the stock market will help offset the 17 million additional retirees.

By having 500,000 new doctors entering the U.S., there will be a huge reduction in medical expenses. We could see doctors’ salaries greatly drop from the average of $381,000 today to probably $250,000 by adding 50% to the doctors, which will lower the cost of procedures and provide far more access. As a requirement for the doctors to arrive, they would need to work at government hospitals or for VA hospitals, with the goal of lowering costs of Medicaid. The 10 year salary would be $100,000 per year for a doctor.

This is the one law that fixes it all, it is actually a big beautiful bill.

Let me recap something that I descovered while writing this: Republicans hate socialists policies and social welfare, however they have created the poverty that has spurred the needs for social welfare. The best hting to do, to reduce the desire to implement socialism in the country, is to raise taxes on the rich. One law that fixes it all!

The solution that fixes it all is to charge the top 160,000 families at least double in taxes and to require them to use the remaining on things the US needs.