China has taken a page out of the old U.S. playbook – the one used to contain the Soviet Union – and applied it with a vengeance on a global scale. Through strategic economic alliances and a calculated exploitation of the dollar’s scarcity in many countries, China is rapidly building a network of dependent nations. This isn’t about ideology; it’s about hard-nosed economic power.

The problem is that too many ill-informed commentators on YouTube and television are predicting China’s decline based on demographics or other factors. This is a distraction from the real issue, and it’s premature. China has no shortage of factory workers, and manufacturing is the engine of its economic growth. While demographic challenges may eventually arise, they won’t significantly impact China until around 2033. If China maintains its current $1 trillion annual trade surplus, its economy could grow by 50% from its current size, surpassing that of the United States.

The China Playbook is not Ideological it is Capitalists

- Dollar Scarcity as Leverage: China strategically limits trade with nations facing dollar shortages, like Pakistan, Argentina, Sri Lanka, and Egypt. Then, it swoops in with yuan-denominated loans and Belt and Road projects, turning these countries into economic satellites.

- Indispensable Partnerships: China cultivates deep trade relationships with major economies like Brazil, Germany, Australia, Japan and South Korea, ensuring they become reliant on Chinese trade. This creates a web of economic interdependence that makes challenging China incredibly costly.

- Out-Importing the U.S.: China strategically surpasses the U.S. in imports from key nations, Indonesia, Malaysia) further solidifying its position as the essential economic partner. For example they say: “We are more important for you than the United States because we buy more from you. Do you want a loan in yuan, or to join the BRICS?” then they demand: “You will join the BRICS if you want to trade with us”

- Undermining U.S. Alliances: China targets key U.S. allies Germany,Tgypt, Brazil, France, Argentina, Japan, Australia, offering more favorable trade deals and partnerships, effectively eroding American influence. The US has done this Major non-Nato Ally with numerous countries and half of them are heavily dependant on China. This is on purpose, not by accident, China undermines US alliances and the US doesn’t even know it.

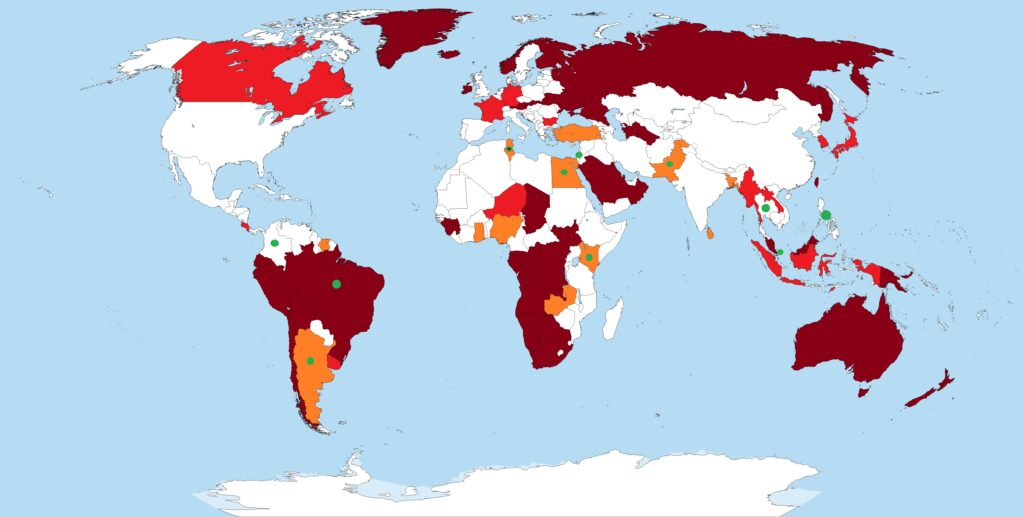

Map Proving the Facts

This map illustrates the complex trade relationships between China and the rest of the world.

- Red: Countries with balanced trade with China (e.g., Canada, Japan, Indonesia, South Korea, Myanmar, Uruguay, Germany, France, Bulgaria). Interestingly, major European powers like Germany and France maintain balanced trade.

- Dark Red: Countries where China runs a significant trade deficit (e.g., Brazil, Peru, Chile, Costa Rica, Australia, Papua New Guinea, Malaysia). Notably, Brazil has a massive trade SURPLUS with China.

- Orange: Countries suffering from dollar scarcity and dependent on Chinese loans (e.g., Argentina, Kenya, Egypt). China is even building Egypt’s new capital city. Only in Argentina has China changed it strategy from exploiting dollar scarcity to buying much more to become an indespensible economic partnery.

- Green Dot: Major Non-NATO Allies. The US has lost influence over Brazil. Argentina is heavily indebted to China. Even NATO allies like France, Germany, and Australia have deep economic ties with China. Australia’s long economic boom is partly due to its trade surplus with China.

This map highlights the challenge facing the US. To effectively counter China’s influence, the US must carefully target its trade policies to avoid alienating key allies while addressing the imbalances with China. There is only one solution and it is not tariffing everyone.

The Stakes

China’s trade surplus fuels its global ambitions. In 2023, it ran a staggering $1.2 trillion surplus with 79 countries. This economic clout finances its diplomatic influence with the countries it really wants to be partners with.

However, its deficits and balanced trade with 50 strategic countries reveal a different strategy: cultivating indispensable relationships. This list includes Australia, Germany, France, Argentina, Brazil, Japan, South Korea, Indonesia, and Malaysia. Brazil, for example, became China’s first “Strategic Partner” in November 2024, signifying a close alliance. This demonstrates how a $60 billion trade surplus with Brazil benefits China. It is no longer just Iran, Russia, North Korea, it is also Brazil and this will grow. News headlines need to list Brazil when they show China’s Alliances.

China uses this tactic globally, and the U.S. has allowed it to happen. Essentially, the U.S. has ceded the globe to China by failing to recognize China’s strategy and counter this strategy effectively. Mainly the United States is not paying attention as it has been distracted by domestic issues and the war on terrorism.

Example’s Brazil and Argentina

China has strategically used trade relationships to exert influence in South America, particularly with Brazil and Argentina. Their approach is consistent: offer seemingly beneficial trade deals and emphasize the resulting trade surplus as proof of their friendship and value as a partner. In Brazil’s case China provides a massive trade surplus.

In Argentina, under the previous left-leaning Kirchner regime, China capitalized on the country’s economic difficulties, attributing them to the US dollar and dollar scarcity. They offered loans in Yuan, portraying themselves as a helpful alternative. However, this assistance came with an unspoken condition: China wouldn’t significantly increase its purchases of Argentine goods. This strategy aimed to keep Argentina in a state of economic vulnerability, dependent on Chinese loans and currency swap arrangements. The Kirchner government, grateful for China’s support, deepened ties and even granted land for a Chinese space base.

When Javier Milei took office with a focus on economic reform, including dollarizing the Argentine economy, China’s strategy shifted dramatically. Recognizing that a stable, dollar-based economy would eliminate Argentina’s need for Yuan loans, China abruptly increased its purchases of Argentine goods by 65% in 2024, creating a trade surplus for Argentina. They are projecting another significant increase in 2025, further solidifying this surplus. Now, China is telling Argentina, “We are indispensable to your growth; look at the trade surplus you have with us.”

China’s sudden change in tactics reveals their true motives. They quickly adapted their approach to maintain their influence in Argentina, realizing that Milei’s policies would resolve the dollar scarcity issue and diminish China’s leverage, and lack of purchases.. Had Milei not taken office, Argentina likely would have joined the BRICS economic bloc, a move that would have significantly benefited China. Therefore, China’s changed approach is a strategic maneuver to retain a partner that is no longer vulnerable.

The U.S. Response

The U.S. cannot afford to sit idly by. It must act decisively to counter China’s growing dominance. Tariffs, strategically deployed, can be a powerful tool to reshape global trade flows. There is no easy solution, but there is a solution. The goal is simple and that is to lower China’s massive, nearly $1 trillion dollar, trade surplus by all means neccessary so they can not conduct this Grand Plan to replace the USA in the world.

- The first step is to achieve balanced trade with China and reduce reliance on critical items that China manufactures. This will reduce China’s trade surplus by $300 billion. This can be done with perpetually gradual tariffs, i.e., increasing them by 2% per month until the trade relationship is balanced.

- The second solution, which I call “Tariffs on Everyone,” would involve imposing tariffs on any product containing Chinese components, regardless of the country of origin. This would also be a gradual tariff, undermining approximately $160 billion in Chinese exports annually. Another $160 billion removed from China’s grips. The first two drops the trade surplus in half, that would put China’s manufacturing sector into a recession.

These two alone remove nearly half of China’s trade surplus, we must face facts, the trade surplus is really a US trade surplus, a little bit of Europe, India, Turkey, Mexico, and Vietnam. However, I don’t care what anyone says, if China sells $460 billion less, it will be a 10% drop in total output for their economy. In 2022, the economy shrank 3.7% after a booming 2021; this 10% drop will have knock-on effects.

- The third requirement is to allow or even insist the yuan to devalue. China may attempt to offset tariffs, but the U.S. should aim to force a collapse of the yuan, turning it into a permanent “soft currency” and preventing it from becoming a major reserve currency. To counter these devaluations, the U.S. must be prepared to raise tariffs every few months to achieve balanced trade. Ideally, China would devalue its currency by 50%. If this happens, the U.S. needs to be ready to impose immediate tariffs on China, of 50% – this high tariff would be a huge revenue generator paid for by the Chinese. The goal is to encourage devaluation while simultaneously increasing tariffs to offset its effects. The devaluation will flood the world with cheap goods, but not the USA with cheap Chinese goods due to the ever increasing tariff. The USA can use this for the next step: To convince a handful of countries to balance trade with China due to the unhealthy Chinese subsidized manufacturing, currency manipulation and dumping.

- Europe, India, Mexico, the Philippines, Thailand, Vietnam, and several other countries have massive trade deficits with China, similar to the USA. In the case of Vietnam and Mexico, the trade deficit is because of China importing goods to these countries, where they go into other products and are then shipped to the USA. The U.S. must use every tool available to encourage these countries to strive for balanced trade with China. If Europe and India, places a blanket tariff on China due to dumping. This could reduce China’s trade surplus by another $400 billion. Europe and India are key, they must balance trade with China.

- To counter China’s exploitation of countries with dollar scarcity, the U.S. and Europe should increase imports from these nations. If Europe, United States and India were to gradually raise tariffs to reduce purchases from China by $700 billion, these products need to come from somewhere.

- Finally, convince as many countries with large populations as possible to drop tariffs against the United States, allowing the U.S. to increase exports. The USA should work by forcing 30 bilateral trade agreements with countries that are in the Global South.

These are the chosen countries the US must prioritize trade:

- Prioritizing countries with trade deficits with the USA such as (1) Argentina, (2) Brazil, (3) Chile, (4) Colombia, (5) Peru, (6) Honduras (7) Domincan Republic (8) Egypt (9) Guatamala (10) Uruguay (11) Paraguay (12) Panama. (13) Paraguay. We can trade more with countries that we have trade surpluses with.

- Prioritize trade with countries that suffered from dollar scarcity and are using the Yuan which are (1) Sri Lanka (2) Pakistan (3) Tunisia (4) Argentina (5) Egypt (6) Nigeria, (7) Ghana, (8) Kenya (9) Ethiopia (10) Zambia (11) Bangladesh (12) Surinam (13) Turkey.

- Prioritize Countries that have major trade deficits with China, as a negotiation: If we buy more from you, you will raise tariffs on China to balance that trade: (1) India (2) Mexico (3) Turkey (4) Nigeria (5) Bangladesh (6) Europe (7) Vietnam (8) Thailand (9) Philipines (10) Thailand (11) Camobodia (12) Colombia (13) Panama (14) Isreal

- Aim to unseat China in countries of strategic location or large population: (1) Indonesia (2) Malaysia.

- By trading with more countries that are not seeking to undermine the dollar, the dollar retains its relevance as the international reserve currency. If we make everything we consume, fewer dollars will flow to the rest of the world, and the dollar will lose relevance as a reserve currency.

- Now on the situation with Brazil, the USA needs to show relevance. If executed correctly China will be forced to import less from Brazil and that will be a chance for the USA to rebuild its place in South America and to undermine China’s strategic partnershp with Brazil, the same way China is unermining US alliances with Trade.

- Lastly, a law needs to be put in place that states if the trade imbalance with any country (except those with populations under 6 million) exceeds 2:1 after 2029, then automatic tariffs of 5% will go into effect and increase annually until the ratio drops below 2:1. This is to prevent an imbalance like the one the US currently has with China from ever occurring again.

Tariffs have become a political football, but how else can the USA realign trade with China? It can’t use quotas, as they are even more restrictive and less effective. The only reason the USA should use tariffs on other countries is to convince them to sign immediate bilateral trade agreements.

The Clock is Ticking

The U.S. must act now to protect its economic and strategic interests. Failure to do so will cede global leadership to China, with potentially dire consequences for the rules-based international order. This is not about protectionism; it’s about using economic leverage to defend American interests and ensure a level playing field in the global economy.

The tariffs are justifiable to achieve balanced trade between the USA and China and Europe and China. Each country chosen is selected to resolve an issue created by China or to lower China’s trade surplus. The USA needs to focus on these 30 countries and Europe.